Q2 2025 Industry Update

by Bibiana Rais | 08 Jul 2025

Q2 GovCon Industry Report

While Q1 delivered a seismic shock to the government contracting ecosystem – marked by sudden layoffs, budget and organizational realignments, and delayed or canceled procurements – clarity has begun to emerge in Q2. With topline increases for the DoD and DHS and actual cuts across most civilian agencies, the federal landscape is now consolidating around clear priorities: defense modernization, industrial resilience, and mission-critical innovation.

In this pivotal moment of adjustment and acceleration, Precision Talent Solutions (PTS) is proud to share our Q2 Industry Update – a sharp, strategy-focused briefing designed to help our industry stay informed and ahead of the curve. Drawing from decades of work alongside contractors worldwide, we provide an insider’s view into the evolving realities of federal acquisition, major program updates, workforce strategy, U.S. and European defense, and M&A activity. As agencies retool for speed, integration, and outcome-driven delivery – particularly in national security, emerging technology, and expeditionary infrastructure – PTS continues to serve as a trusted partner in executive search, talent strategy, and government contracting market intelligence.

Key Trends Observed in Q2:

· Pivot to INDOPACOM – Elbridge Colby’s confirmation as Under Secretary of Defense for Policy cements a decisive shift toward the Indo-Pacific. Colby is expected to drive reforms in force posture, acquisition priorities, and strategic planning to strengthen deterrence against China. What will this recalibration mean for global posture and U.S. commitments worldwide?

· $150B Defense Bill Redraws the Pipeline – The Senate passed a sweeping reconciliation package containing a $150B defense boost, the largest single-year increase in modern history. The bill prioritizes munitions, shipbuilding, missile defense, unmanned systems, sustainment, and advanced manufacturing. These are unmistakable signals of an urgent push to accelerate U.S. production capacity. Can industry respond at the pace and scale to these unprecedented demands?

· Europe’s 5% Moment – NATO’s formal adoption of a 5% GDP defense spending target at the June summit marks a generational turning point in European security strategy. With an expanded forward presence and deeper industry engagement, the Alliance is retooling how it equips, procures, and prepares for long-term conflict. For first-hand insights, read LTG Andrew Rohling’s 2025 NATO Summit Dispatch. How will defense contractors position themselves in this rapidly evolving transatlantic market?

· DHS Gold Rush – The newly passed domestic spending package delivers an unprecedented $171B boost to DHS, fueling major expansions in enforcement, detention, mobility, infrastructure, and federal-local law enforcement integration. With DoD-DHS coordination back in play and surge-ready vehicles like LOGCAP V and WEXMAC, contractors face a once-in-a-decade pipeline across construction, O&M, medical, aviation, and contingency support.

· Federal Talent Revolution? – OPM’s new Merit Hiring Plan is a bold attempt to modernize the federal workforce with 80-day hiring goals, shared talent pools, skills-based assessments, and SME-led evaluations. The goal is faster, smarter hiring that reflects private-sector agility. Could this finally be the shake-up federal hiring needs?

· Between Deterrence and Disengagement – As tensions escalate between Israel and Iran, the U.S. is repositioning CENTCOM assets and scaling down its diplomatic presence while assessing damage to Iran’s nuclear program. With diplomacy faltering and fears of broader conflict or a nuclear-armed Iran growing, CENTCOM’s posture statement highlights the risks of regional war and the dilemma facing U.S. policy: reduce engagement or prepare for renewed military commitments.

· Command Shakeup on the Horizon – A top-to-bottom AFRICOM reorganization is under active review, with potential merger into EUCOM and significant posture and base closure changes under consideration. Similar structural changes are being explored across other Combatant Commands, including a possible consolidation of NORTHCOM and SOUTHCOM into a unified “Americas” region, and a bifurcation of INDOPACOM into northern and southern theaters. While intended to streamline command alignment and acquisition oversight, these proposals raise industry concerns over surge readiness, contract sizing, and implementation uncertainty.

Transformation is reshaping the federal landscape, and with it come real opportunities. At PTS, we help our customers stay ahead, from executive placements, bid strategy to real-time capture support, talent mapping, and industry intel. Learn more from Jake Frazer’s recent podcast on navigating changes in GovCon.

GovTech

Q2 marked a turning point in the government technology landscape. The pivot is clear: agencies are moving beyond legacy IT rollups toward mission-driven, deployable tech – prioritizing speed, resilience, and interoperability at the edge. Across programs and platforms, buyers now demand AI-native software, zero-trust cloud environments, offensive cyber capabilities, and autonomy solutions that deliver direct operational impact. M&A activity mirrors this shift, with PE-backed defense tech absorbed into larger platforms, mid-tier consolidators expanding in propulsion and mission systems, and software-native primes scaling aggressively. To deepen industry relationships or identify your next teaming partner, explore the newly released Top 100 ranking of federal tech contractors by Washington Technology.

· AI in the Field – Agencies like DHS and GSA are moving beyond pilots, deploying AI tools in frontline operations. Firms like Palantir, Shield AI, and Anduril are capturing share by delivering dual-use platforms at speed. Upcoming procurements include the Army’s Intelligence Data Platform (AIDP) Cloud to Edge and AAMAC ($15B) creating DoD-wide AI acquisition channel, AIS@P MATOC ($1B) focused on rapid AI/ML development, and State’s GenAI Contracting Assistance Tool Support Services.

· Embedding Tech Leadership – In a bold move to fuse private-sector innovation with military modernization, the Army launched Detachment 201, an Executive Innovation Corps composed of senior executives from Palantir, Meta, OpenAI, and Thinking Machines Lab sworn into the Army Reserve as Lt. Colonels to advise on scalable, rapid tech deployments.

· Secure Software at Speed (SWFT) – The DoD launched three RFIs under its Software Fast Track (SWFT) initiative, targeting modular, fast-validated, and secure software acquisition.

· Anduril’s $30B+ Momentum – The defense tech unicorn’s valuation reflects investor confidence in scalable, dual-use innovation. With global expansion, new sites like Arsenal-1, partnerships like Archer (eVTOL), and battlefield-ready systems, Andruil is challenging traditional primes across domains.

Major Awards:

· ManTech secured a $200M, 5-year contract to modernize NOAA’s Security Operations Center, transitioning legacy systems to modular, AI-enabled cyber infrastructure.

· GDIT was awarded a $396M contract to overhaul SOCOM’s networks with AI, zero-trust architecture, and multi-cloud services. GDIT is also supporting digital modernization in CENTCOM and delivering capabilities in SOUTHCOM.

· OpenAI Public Sector launched with a $200M award from the Pentagon’s CDAO to provide secure, AI-powered tools tailored to federal missions, underscoring the government’s push for advanced, explainable AI across agencies.

As GovTech matures, the bar is rising. Agencies aren’t just modernizing; they are operationalizing innovation. PTS continues to grow in this evolving space, delivering high-impact talent in AI, cyber, cloud, and engineering, backed by Account Executives Isaac Khaneles and Candice Smith, who speak both mission and tech.

Key Q2 Procurement Updates

· Mapping the Executive Orders – Since January 2025, over 157 Executive Orders (EOs) have been issued, reshaping the federal acquisition landscape. From workforce reform to modernization mandates, contractors must proactively track these changes. It is no longer about compliance – it’s about positioning.

· GWAC Consolidation Era Begins – GSA, OMB, NASA, and NIH have begun consolidating major IT GWACs in line with EO 14240. With DHS canceling PACTS III and FirstSource III, and GSA absorbing over $400B in projected spending, the landscape is shifting rapidly. Fewer vehicles, bigger ceilings, new rules – what will competition look like in this streamlined future?

· FAR 2.0 Reshapes the Rules –FAR 2.0 rewrites rules with updated definitions and changes across several Parts, affecting software, services, tech licensing and pricing. Contractors face tighter compliance requirements, new risk frameworks, and increased scrutiny regarding classification and market fit. BRG’s analysis highlights these trends. Are you prepared to compete under the new rules?

MAJOR PROGRAMS

ARMY

Happy 250th Birthday, U.S. Army! In May, SECDEF Hegseth announced a sweeping Army reorganization, repositioning resources and posture toward homeland defense and INDOPACOM, including a dedicated Theater Army HQ for the Indo-Pacific, reallocating units from Europe and CENTCOM, and retooling force design to emphasize long-range fires, air and missile defense, cyber and electronic warfare, space, and expeditionary logistics.

· LOGCAP VI – Exciting times ahead for the LOGCAP Program! The Army has officially shelved LOGCAP 5.5 pivot and launched the full transition to LOGCAP VI. On June 6, an Industry Day outlined the program’s next phase, following an RFI that sought input on structure, metrics, and teaming approaches. This recompete positions LOGCAP VI as one of the most consequential logistics programs of the decade, with significant opportunities for both incumbents and new entrants.

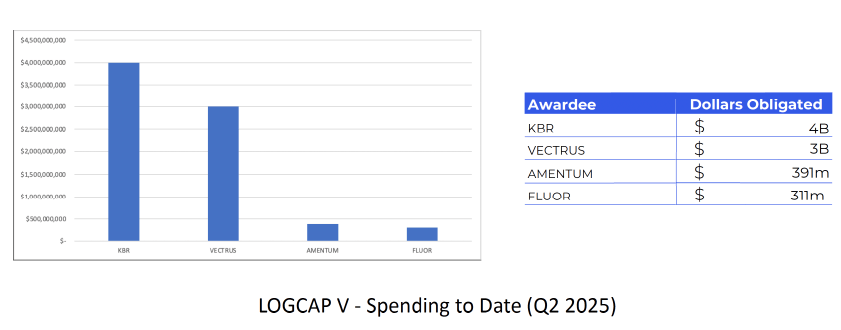

· LOGCAP V – remains in play through 2030! Despite the shift to LOGCAP VI, the current LOGCAP V contract remains active and underutilized, leaving room for substantial contracting activity over the remaining five years.

o As of FYQ2, only ~20% of its $82B ceiling has been obligated.

o Southern Border Support – In response to the Presidential National Emergency Declaration at the southern border, KBR was awarded a sole-source TO supporting U.S. Army North (ARNORTH) and Joint Task Force–Southern Border (JTF-SB) operations at Dona Ana Base Camp, Texas. The task order includes a full range of logistics services, including camp construction, power generation, medical, food, waste, fire, and transportation support. KBR was selected as the only LOGCAP V contractor currently positioned within the NORTHCOM AOR.

· EAGLE II BOA – ACC-RI released Step II RFP with proposals due by July 10, under a total SB set-aside. The BOA offers 5-year access to task orders with an estimated $390 ceiling for FY26, covering both CONUS and OCONUS operations. The EAGLE program supports field maintenance, supply, and transportation services across LRCs, APS, and sustainment missions worldwide. Although still active, Army discussions suggest EAGLE II may phase out by FY27, with future logistics needs likely transitioning under LOGCAP.

· GPSS IDIQ – Seven awardees, including Acuity, GardaWorld, Constellis, Allied Universal, SOC, PGI, and Continuity, have been selected for the Army’s $10.3B, 10-year Global Protective Security Services (GPSS) IDIQ contract to deliver armed and unarmed security for contingency operations, peacekeeping, humanitarian efforts, and garrison support in OCONUS locations.

· TLRaC MAC 3 – Eleven vendors secured spots on a $379M, 5-year Live Training, Ranges, and Combat Training Centers (LTRaC) MAC 3 IDIQ to support live training environments, range operations, and combat training modernization.

· CACI secured a $437M, 7-year task order to continue delivering mission support services to USAFRICOM.

· Amentum received a $7.8M modification under the $120M, 7-year Army’s global aviation and maintenance services contract originally awarded in 2024.

· Chenega Tri-Services was awarded a 1-year, $22.7M contract to perform physical exams and review medical records at Military Entrance Processing Stations.

· The Arcadis-Pond JV has been awarded a $247M MATOC contract by USACE Europe District for A-E Services to support MILCON projects across Germany, Poland, Czechia, Belgium, Luxembourg, the Netherlands, Norway, and Denmark.

· Fifteen companies will compete under a $7B, 8-year USACE contract for the design-build and design-bid-build horizontal construction task orders.

· AECOM, Jacobs, MBI, Tetra Tech, WSP, and eight other companies were awarded positions on a $249M, 5-year USACE A-E services contract.

Whether you’re defending recompetes or scaling complex global operations, PTS delivers the executive firepower, strategic insight, and operational depth to help you win. From BD leadership to on-the-ground experts who understand the mission, we align talent with your growth strategy – at speed, and with precision.

NAVY

The U.S. Navy continued to advance its modernization agenda amid tightening resources and growing demands in the Indo-Pacific region. Flagship efforts, such as Unmanned Service Vessel (USV), Project Overmatch, and distributed ISR programs, reflect a bold pivot toward C5ISR-enabled maritime operations. Yet, recent CBO assessments and Indo-Pacific force posture reviews highlight that ambition alone won’t close the gap – industrial reform is essential.

· Project 33 – The Navy unveiled Project 33, a sweeping effort to deploy autonomous systems fleet-wide by 2027, including unmanned surface and subsurface vehicles, AI-driven deception, logistics, and C5ISR integration.

· USV – In June, the Navy hosted an Industry Day to outline requirements for the future Unmanned Surface Vessel (USV) fleet focused on modular design, autonomous navigation, and advanced sensor fusion. RFI is expected in Q3.

· WEXMAC 2.0 – More than 78 task orders have been issued in the first half of 2025 under this $2.85B, 10-year IDIQ awarded to 87 vendors last year to support scalable expeditionary logistics. Notable awards include support for Southern Border operations, with task orders issued to Obera ($25M), Acquisition Logistics ($16M), Wayport ($4.6M), and Red Orange ($5.4M). A new TO is also underway for an ICE detention facility at Fort Bliss, a key staging hub for CBP and broader border enforcement missions.

· WEXMAC 2.1 TITUS – NAVSUP has released a draft solicitation for a $10B IDIQ to provide rapid expeditionary support across the U.S and Alaska. The contract enables full-spectrum operations, including life support, logistics, transport, medical comms, and DSCA missions for DOD, DHS, and other federal agencies.

· The Pentagon launched a review of the Aukus submarine deal with Britain and Australia, a key plank of defense in the Pacific against China’s increasingly expansive naval threat.

OCONUS NAVY BOS Update

· KBR was awarded a 7-year, $476M BOS contract for Camp Lemonnier, Djibouti – the Navy’s primary hub in East Africa.

· Diego Garcia and Sigonella RFPs remain delayed, now expected in Q3. The Souda Bay BOS award is also anticipated in Q3.

· V2X is executing a $98M BOS contract in Poland, Centerra holds a $54M contract (through 2032) in Singapore, and Valiant/Alca JV remains incumbent at NSA Naples.

PTS supports Navy contractors with specialized talent across base operations, engineering, logistics, and program execution. From former Seabees and CEC officers to licensed engineers, trades professionals, and PMO teams, we help BOS teams staff and sustain high-performance operations across CONUS and OCONUS task orders.

· MACC – Proposals were submitted May 29 for the Navy’s $8B Multiple Award Construction Contract (MACC) covering large-scale infrastructure projects worldwide. Award expected in Q4.

· DPR-RQ Construction JV was awarded a $227.5M contract for a new medical facility at Naval Station Guantanamo Bay (NSGB), Cuba.

· V2X secured a $103M, 5-year contract to sustain the Navy’s C-26 aircraft fleet.

· NAVFAC Pacific awarded a $990M Indo-Pacific MACC contract to 12 companies to deliver resilient infrastructure across INDOPACOM.

· Amentum won a $34M modification to its $155M Navy BOS contract at MCAS Iwakuni, Japan.

· Two separate contracts were awarded for NSA Souda Bay, Greece: Aktor secured a $43.9M contract to construct a Joint Mobility Processing Center, while IAP received a $67.6M contract for facility operations support, including housekeeping and custodial services.

AIR FORCE

The FY26 Defense Reconciliation delivers a major boost to the AF’s munitions and modernization priorities. With $6.5B allocated for long-range fires, the service is ramping up procurement of advanced weapons systems, including hypersonics, JDAMs, and long-range anti-ship missiles, while confronting industrial base constraints and munitions inventory gaps. An additional $1B in spares and sustainment will improve F-35 readiness and operational availability. However, procurement of new fighters remains capped at 45, underscoring the AF’s pivot toward Collaborative Combat Aircraft (CCAs), next-gen unmanned systems, and software-defined capabilities aimed at the Indo-Pacific threat environment.

· Force Restructuring – AF will retire all remaining A-10s and cancel the E-7 Wedgetail program, signaling a shift from legacy platforms to tech-enabled systems and unmanned force design.

· AF Overhaul – As organizational debates intensify, more voices are calling for the AF to be broken into four mission-driven services – Tactical Air, Strategic, Space, and Global Lift & Logistics – each integrated with its relevant combatant command. The concept aims to eliminate duplicative command structures and acquisition bottlenecks.

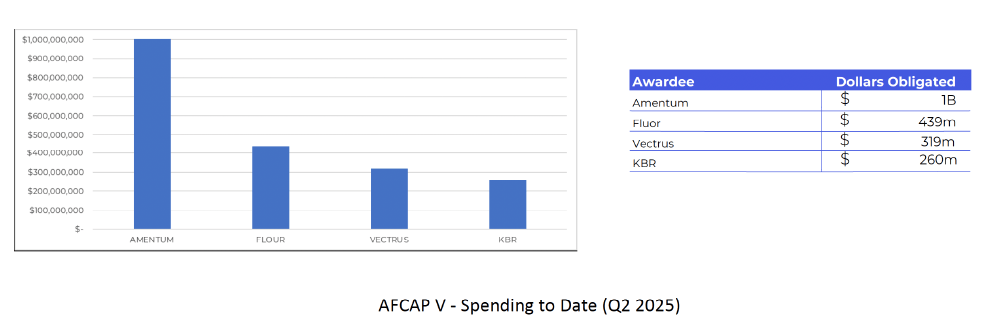

· AFCAP V – As of June 2025, $2.74B has been obligated across 76 task orders, reflecting 43% utilization of the contract ceiling with just under three years remaining before the contract reaches the end of its performance period. While only two task orders have been awarded in 2025 – KBR’s $85M award for AM-2 airfield matting kits and V2X’s $140M award for Space Force support at Ascension Island – industry may experience increased TO activity in FY26–FY27, as USAF ramps up mission support and positions for the next recompete cycle, likely to begin in mid-2027.

· V2X has secured a sole-sourced, $118M contract to support the Iraqi F-16 program.

· Amentum has been awarded a $64.7M modification on the $434.5M AF Global Pre-Positioned Materiel Services support contract.

· RMGS won a $22M task order for joint terminal attack control instructor support services for the AF Special Operations Command units.

PTS helps Air Force contractors build agile, mission-ready teams across engineering, logistics, construction, and sustainment. With deep experience supporting AFCAP, BOS, and expeditionary programs, we deliver vetted professionals, from civil engineers to side leads, PMs, and trades staff. Whether filling urgent surge roles or long-term billets, we help our customers stay agile and ready to perform in dynamic, global environments.

Defense Logistics Agency (DLA)

As of mid-2025, DLA’s procurement environment remains complex and constrained by persistent challenges, including long acquisition timelines, evolving requirements, and widespread contractor concerns over DOGE-driven efficiency reforms. While streamlining efforts continue, many high-value programs remain delayed, forcing bidders to manage heightened risk and cost volatility.

Subsistence Prime Vendor (SPV)

· Middle East – The SPV award for Iraq, Jordan, Kuwait, and Syria is delayed, with potential scope adjustments due to escalating regional instability. Awards are expected in Q3.

· Northern Europe – Proposals for the $1.1B SPV Northern Europe contract, covering 180+ delivery sites across 16 countries, including Ramstein, Kaiserslautern, Baumholder, and Grafenwoehr, were submitted May 6. Following a pre-award protest, DLA TS has resumed evaluation. Awards are expected in Q4.

· Southern Europe – RFI responses were collected in April; RFP is scheduled for Q3.

· SWAEA – DLA is finalizing a new acquisition strategy for Southwest Asia and Eastern Africa (SWAEA), integrating existing SPV Programs in Southern Arab Peninsula and Nations of Eastern Africa (SAPNEA), Bahrain, Qatar, and KSA.

· Asia Pacific – Awards for Japan, Singapore, Philippines, Diego Garcia, and Australia are expected in Q3.

· Americas – Norfolk land customers (including GTMO and Honduras) saw an RFI in Q1; RFP pending in Q3.

Maintenance, Repair & Operations (MRO)

· Pacific Region – RFIs for Zones 1 & 2 were collected in April; RFP is expected in Q3.

· Europe and Africa – A Tailored Logistics Support (TLS) RFP for MRO across three new zones – North and South of the Alps, and Africa, is forthcoming. Noble, TWI, and SupplyCore continue service under the current $916M contract through May 2026.

· Alaska/CONUS – SupplyCore was awarded a $75M bridge contract to continue MRO support while DLA finalizes awards for the delayed CONUS-Alaska-Hawaii recompete.

Distribution Programs

· Industry Day – DLA Distribution hosted an Industry Day in May to preview forecasts for recompetes in CONUS/OCONUS storage, distribution, transportation, and contingency operations.

· DECAP – Proposals closed on June 23 for the $477M Distribution Expeditionary Capabilities (DECAP) IDIQ. The contract includes global rapid-response support (deployable within 48 hours), disaster relief, foreign aid, humanitarian assistance, 4PL) support, and contractor-operated distribution centers.

PTS brings over 25 years of expertise supporting DLA’s SPV and MRO programs. We understand the operational demands and acquisition complexities that define these robust, performance-driven contracts. From bid strategy and teaming to identifying the right supply chain, logistics, and program talent, PTS helps partners compete, win, and deliver across global DLA missions.

· Pharmaceutical Prime Vendor – DLA awarded a $30.3B PPV contract to six vendors, ensuring supply chain continuity across more than 1,300 CONUS and OCONUS medical facilities.

· Valiant received a $10.5M option under its 3-year, $51M 3PL HAZMAT services contract.

· African Lion 25 – In May, DLA Distribution Europe played a critical role in African Lion 25, AFRICOM’s largest annual exercise, by delivering bulk fuel and logistics support across Tunisia, Ghana, Senegal, and Morocco.

DHS

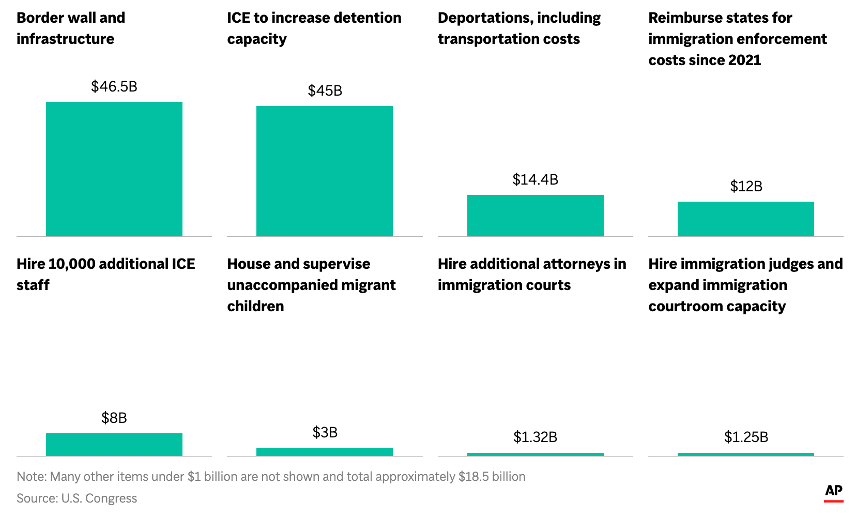

With the signing of the President’s signature domestic policy bill (OBBBA) into law last week, DHS secured a historic $171B federal investment in immigration enforcement. The sweeping legislation dramatically expands DHS capabilities over the next 5 years, funding new detention infrastructure, accelerating border wall construction, hiring over 10,000 new ICE agents, and deepening federal partnerships with state and local law enforcement. This surge reactivates DoD-DHS operational integration, unlocking significant opportunities for contractors across construction, logistics, O&M, mobility, and contingency operations.

· Emergency Detention – ICE awarded 40 companies a $10B IDIQ for Emergency Detention and Related Services to rapidly expand detention capacity nationwide. The 2-year contract (with a possible 6-month extension) covers 8 key areas, including facility operations, transportation, security, medical care, detainee processing, and access to legal resources.

· Border Wall Expansion – CBP awarded a $309.5M contract to Fisher Sand & Gravel for 27 miles of a new vertical border wall in Santa Cruz County, Arizona (Tucson Sector). Secretary Noem also signed a waiver to speed up the construction of up to 17 miles of wall in Texas’s Rio Grande Valley Sector, showing DHS’s push to close gaps left by canceled contracts.

· Border Infrastructure – CBP issued a $334M delivery order to Fisher Sand & Gravel under a larger $4.1B IDIQ for border infrastructure. This task involves building new vertical barriers in Tucson, Arizona.

· ICE Threat Mitigation and Monitoring – ICE collected RFIs for upcoming requirements related to threat monitoring and mitigation capabilities.

· TPVS 2.0 – CBP started the recompete of the Traveler Processing and Vetting Software (TPVS 2.0) program. RFIs are due by July 22. The program aims to improve CBP’s watchlist, identity resolution, and travel vetting systems.

· ICE ERO Air and Ground Transportation – A recompete for this $100M IDIQ currently held by MVM is underway. The program covers domestic and international transport for unaccompanied children and family units in ICE custody. RFP is expected in Q3, with an award anticipated in Q4.

· IDIQ Cancellations – DHS officially canceled the evaluation of proposals under the PACTS III IDIQ ($8.4B), citing the program as non-mission critical and redundant with GSA offerings. It plans to instead leverage GSA’s OASIS+ and MAS schedules to meet future needs. FirstSource III IDIQ ($10B) solicitation was also canceled.

SPACE FORCE

The U.S. Space Force (USSF) is rapidly maturing into a core pillar of national defense, sharpening its focus on domain integration, missile warning, space-based C2, and multinational collaboration. With a proposed $29B RDT&E budget for FY26, a nearly 60% increase over FY25, the service is prioritizing investments in missile defense, resilient satellite networks, AI-enabled C2, and rapid launch capabilities.

· Space as a Warfighting Domain – USSF is seeking operational control over all U.S. counterspace capabilities, currently spread across military branches. This consolidation signals a doctrinal pivot, treating space as a warfighting domain on par with air, land, sea, and cyber. The alignment with broader DoD priorities – AI, software modernization, rapid acquisition – is accelerating industry engagement.

· Golden Dome – Now a key priority for this Administration, the Golden Dome aims to create a multi-layered, AI-powered homeland missile defense shield, integrating Aegis, THAAD, and space-based sensors through AI-driven C2 systems. While the MDA’s cancellation of its space-based interceptor industry day in Q2 raised execution concerns, USSF remains central to managing orbital sensor layers and future intercept architecture. CBO estimates long-term costs could exceed $500B, signaling vast opportunity for next-gen defense tech entrants.

· Organizational Realignment – The relocation of U.S. Space Command HQ from Colorado Springs, CO to Huntsville, AL is nearly finalized, further integrating national missile defense, NASA, and space acquisition activities. This move has major implications for workforce alignment and regional industrial ecosystem.

· International Strategy – USSF is finalizing its first international space strategy, focused on accelerating allied integration, tech transfer, and interoperability. This follows its 2024 commercial strategy and signals a cohesive roadmap for multinational operations in contested orbital environments.

· Multinational Readiness – US Space Command led Global Sentinel 25, a flagship domain awareness exercise with 25+ nations. Meanwhile, USSF Europe and Africa deployed to Morocco and Italy for Africa Lion 2025, reinforcing readiness through joint electronic warfare training.

Key Awards:

· GPS Modernization – Lockheed Martin received a $510M contract modification to expand GPS III Follow-On (IIIF) satellite constellation, enhancing global PNT (position, navigation, and timing) resilience and survivability in denied environments.

· Mission-Critical C2 – Palantir secured a 5-year, $217M contract from Space Systems Command to build a Space C2 data platform, enhancing orbital threat detection, cloud analytics, and command interoperability.

· Range Transformation – Jacobs was awarded a $4.1B contract to modernize the Eastern and Western Ranges, transforming legacy infrastructure into multi-use launch platforms for DoD and commercial missions.

· IAMD – Hanwha and Northrop Grumman signed an MoU to collaborate on next-gen IAMD architecture, focused on integrated sensors, AI-enabled C2, and layered intercept capabilities.

PTS is actively supporting the growth of space-related programs and talent across the defense industrial base. Reach out to Isaac Khaneles to explore partnership or hiring strategies aligned with the future of U.S. space operations.

STATE

The State Department (DOS) entered mid-2025 amid a broad consolidation, cutting over 2,000 positions, merging 45% of its bureaus and offices, and integrating remnants of USAID. These highly contested reforms aim to make decision-making more efficient by consolidating authority in regional bureaus and eliminating programs. At the same time, a national review of foreign aid has shifted from initial program curtailment and cancellation to an FY25 rescission package, further considerations in the FY26 budget request, and a review of U.S. participation in – and thus funding to – international organizations.

· GLOBALCAP – The $5B, 10-year GLOBALCAP IDIQ was awarded to 16 vendors, consolidating AFRICAP and GPOI into a unified platform covering stabilization, logistics, training, equipment, and construction. With task orders prioritized in Sub-Saharan Africa but open globally, this contract is positioned as the State’s primary contingency contracting vehicle. SDVOSB/WOSB awardees include B360-T12 Tech JV, Downrange, F3EA, Global Dimensions, KVG, Nelogis, RMGS/Berger JV, and Skybridge. F&O competition pool includes Amentum, Culmen, KBR, MAG, Relyant, Sincerus, and Valiant.

· GATA III – This $765M, 5-year Global Antiterrorism Training Assistance (GATA) III IDIQ awarded to Amentum, IDS, Linxx, and Sincerus is regaining momentum after an early task order protest was resolved. Multiple TOs are expected in Q3.

· GLOBAL ADVISORY – Proposals closed May 6 for this $250M, 5-yr IDIQ contract replacing GASS and AF Advisory. Awards are expected in Q3 across full/open and SDVOSB/WOSB pools with scope to cover advisory, OCONUS logistics, evacuation support, and sustainment.

· PEPFAR – DOS continues to consolidate global health programming under regional platforms, shifing from multilateral funding to direct implementation. PEPFAR remains in limbo; while existing programs are funded via continuing resolutions, new awards are paused pending congressional authorization. Shimon Prohow explores what this means for the future of PEPFAR and the millions who rely on it.

· WASS Demobilization – AAR secured a $26M award from INL for demobilization services in Iraq under the Worldwide Aviation Support Services (WASS) contract.

As GLOBALCAP, GATA III, and other DOS IDIQ vehicles ramp up for a busy season of high-volume task orders, prime contractors face increasing pressure to submit compliant, fully staffed TO proposals. PTS fills this critical gap with its tailored bid and proposal support, helping capture teams swiftly find hard-to-fill LCATs and provide qualified, resume-ready candidates within tight deadlines. Andrew MacWilliams highlights how PTS helps address recruiting gaps during proposals, as missing key personnel shouldn’t mean a no-bid.

Overseas Building Operations (OBO)

OBO continues to drive forward diplomatic infrastructure modernization through strategic IDIQ and direct industry engagement:

· Worldwide A&E – OBO launched a new global vehicle for A&E services to design, secure, sustainable facilities globally. Check all OBO current IDIQ and renewals here.

· Capabilities Conversations – Monthly virtual briefings resumed, offering firms 20-minute slots to engage with OBO technical decision-maker. Sign up here.

· NDAA Industry Session – On May 20, OBO and A/GA briefed industry on changes to ccontractor qualification process. Download the presentation, watch the video, or access the recording transcription.

· Physical Security Upgrades – An $83M award was issued to Hana-Nati, East Coast Technologies, International Construction Services, Olgoonik, and Horizon Construction for embassy hardening and infrastructure upgrades.

PTS joined 300+ industry leaders at the 34th Annual DSF Charity Golf Outing at Lansdowne in June. Robyn Cronin volunteered at the event, connecting with partners and peers dedicated to protecting U.S. personnel and facilities worldwide. Whether you’re pursuing design-build contracts, recompeting IDIQs, or managing physical security upgrades, we ensure you’re staffed for success. From assembling cleared teams and placing experienced PMs to advising on executive transitions and long-range growth, PTS helps DOS contractors navigate the complexities of global diplomatic infrastructure with precision and agility.

FMS

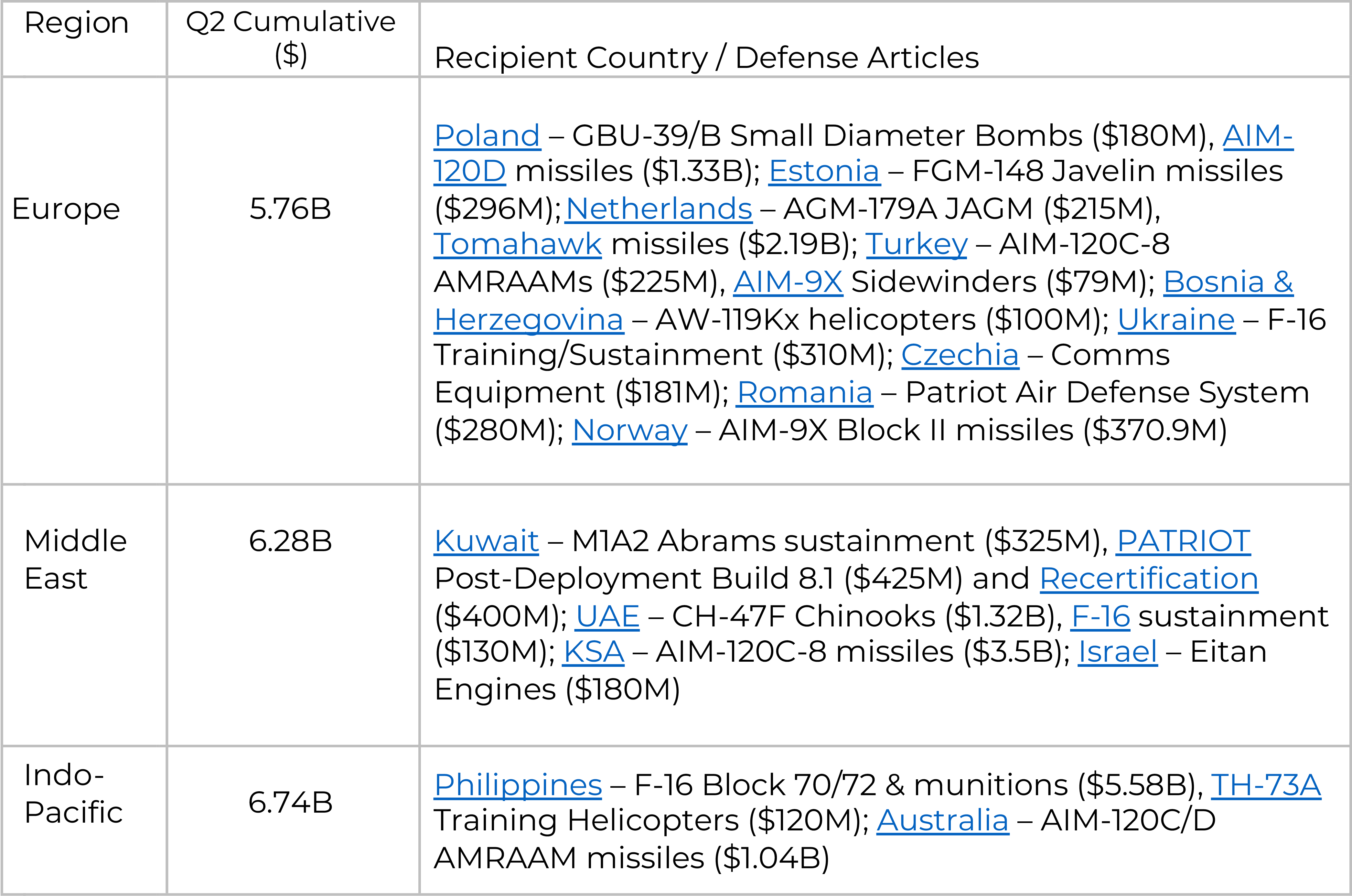

Foreign Military Sales (FMS) surged ahead in Q2, reaffirming the program’s indispensable role in advancing U.S. global defense strategy. With over $18.5B in approved cases this quarter alone, FMS continues to enhance allied capabilities across Europe, the Middle East, and the Indo-Pacific – reinforcing deterrence, air superiority, and coalition interoperability in frontline theaters.

This momentum reflects both strategic urgency and structural reform. In April, the administration launched a sweeping FMS modernization initiative via executive action to eliminate red tape, accelerate approval timelines, prioritize alignment with Combatant Command requirements, and open clearer pathways for industry engagement.

Recent commitment by NATO Allies to increase defense spending to 5% of GDP, alongside bilateral negotiations with partners in the Indo-Pacific and Middle East, signal continued demand for FMS-supported solutions, particularly in air defense, ISR, munitions, and naval modernization. As allied nations invest in readiness and deterrence, the services tail of these platforms – training, logistics, sustainment – is also expanding, creating significant opportunity for U.S. industry.

MERGERS & AQUISITIONS

Q2 saw a modest slowdown in overall deal volume, but GovCon M&A remained focused and mission driven. Buyers are doubling down on deployable tech – targeting autonomy, tactical edge computing, ISR, cybersecurity, and space systems – to stay ahead of tightening budgets and slow prime contract cycles. The market clearly prioritizes integrated tech stacks built for speed, resilience, and operational relevance in contested environments. Meanwhile, softened demand in broader government services, driven by cost-cutting campaigns, has put traditional service-sector deals on ice, reinforcing the shift toward technology-forward consolidation. Reduced funding in international development and humanitarian programs is also prompting a second wave of sectoral M&A, expected to accelerate through Q3 and Q4.

· Rocket Lab acquired Geost ($275M + $50M earn-out) to integrate electro-optical (EO) and infrared (IR) sensors for missile warning and space-based ISR, positioning itself as a contender for Golden Dome with vertically integrated, rapid-launch capability.

· Anduril acquired Klas to strengthen rugged tactical compute and comms via the Lattice AI platform, enhancing battlefield autonomy and modular deployment.

· Redwire (AE Industrial Partners) bought Edge Autonomy for $925M, merging ISR-capable UAS with space infrastructure in a bid for cross-domain dominance.

· Serco completed its $327M acquisition of Northrop Grumman’s Mission Training & Satellite (MT&S) Ground Systems business, adding ~1,000 staff and expanding synthetic training and SATCOM capacity.

· Tyto Athene acquired StackArmor to bolster its cloud and cyber compliance portfolio, integrating FedRAMP, FISMA, and CMMC automation into its offerings.

· Lockheed Martin acquired Amentum’s Rapid Solutions hardware unit for $360M, to expand tactical comms and support its integrated battle management system architecture.

· Karman Space & Defense acquired MTI ($90M) for hypersonic components and ISP ($50M) to boost small rocket/UAS propulsion capabilities.

· Leidos purchased Kudu Dynamics in a $300M all-cash deal, sharpening its edge in offensive cyber, AI-based vulnerability research, and classified cyber operations.

· Snowflake acquired Crunchy Data to add secure PostgreSQL and AI-ready database solutions to its GovCloud portfolio, enhancing high-assurance cloud services for defense agencies.

· VTG acquired Byte Systems, iota IT, Tunuva, and Triaplex. This quadruple acquisition enhances VTG’s capabilities in cyber, mission IT, analytics, and specialized RF and SIGINT technology in classified ISR and electronic warfare.

· AeroVironment acquired BlueHalo (ACP), adding counter-UAS, electromagnetic warfare, and space capabilities to its growing defense tech portfolio.

· Ultra I&C acquired Expeditionary Engineering, bringing in tactical software-defined systems and mobile C5ISR platforms to reinforce expeditionary mission support.

As the acquisition landscape shifts toward resilience, speed, and mission-driven technology, consolidation is increasingly focused on capabilities that excel at the tactical edge. Whether in autonomy, cyber, or advanced ISR, the market rewards companies that can integrate quickly and perform under pressure.

PTS supports GovCon firms navigating transformation – whether scaling through acquisition or restructuring to adapt. We deliver executive talent, P&L leads, tech teams, and functional experts across the full acquisition lifecycle ready – from strategy and program execution. When transitions involve workforce shifts, our Precision Experts and Career Concierge services help displaced personnel land on their feet and continue delivering mission value.

EUROPEAN DEFENSE SECTOR

With NATO’s formal adoption of a 5% GDP defense spending benchmark in June, Europe’s rearmament push entered a new phase – one defined by urgency, alignment, and long-term industrial planning. Member states including Poland, France, Germany, Finland, and the Baltics are accelerating investments in ISR, air and missile defense, and uncrewed systems, and strategic lift capabilities. The UK’s newly released Strategic Defense Review (SDR) reinforces this pivot with a sweeping modernization agenda. Meanwhile, EU-level frameworks like PESCO and EDF are reshaping procurement coordination, as emerging multilateral agreements point toward a future of integrated defense ecosystems and transatlantic resilience.

· Operational Shift to NATO – The U.S. is stepping back from Ukraine, handing operational leadership to NATO and the EU. Germany is now leading the Ukraine Defense Contact Group (formerly NSATU), driving reforms to improve coordination, transparency, and the speed of military aid delivery.

· PESCO Expansion – The EU approved 11 new defense projects, from integrated air/missile defense to cyber doctrine and soldier systems. In a notable shift, Switzerland joined the Estonian-led EU Permanent Structured Cooperation (PESCO) cyber defense initiative, marking its first participation in a formal EU military framework.

· EU-Canada Defense Pact – The EU and Canada signed a security and defense partnership enabling Canadian participation in the €150B SAFE joint military procurement loan, a major boost for transatlantic defense ties.

· New Eastern Pillar – Poland is redefining NATO’s eastern flank with record defense spending approaching 5% of GDP, large-scale acquisitions of U.S. platforms, and major strategic investments in domestic manufacturing and logistics capacity. Poland is emerging as both a forward-operating hub and a key industrial player in Europe.

· Dual-Use Innovation – European defense startups are attracting major capital. Helsing, Quantum Systems, and Isar Aerospace are leading a new generation of dual-use ventures aligned with European strategic autonomy goals, including AI-enabled drones, battlefield ISR, and sovereign launch capabilities.

European Defense M&A Activity:

· A consortium led by Advent reached a £3.8B deal to acquire Spectris, a UK firm specializing in precision testing and software.

· Iveco approved the spin-off of its ~€1.3B defense business, with interest from Indra Sistemas and a Leonardo-Rheinmetall JV.

· Hexagon is preparing to separate its Asset Lifecycle Intelligence division and acquire APEI to enhance its aerial mapping capabilities in Europe.

· TKMS Marine Systems is set for a partial IPO.

· Andruil and Rheinmetall launched a partnership to co-develop drones for Europe, merging American tech with European platforms.

PTS supports the evolving workforce needs of Europe’s defense sector. With 75% of our team based in Europe and extensive partnerships across NATO and EU clients, we are uniquely positioned to help companies recruit, grow, and compete in this rapidly transforming market. Contact PTS European Defense Market Lead Jim BowdenJim Bowden to explore how PTS can support your transatlantic growth strategy.

UK MOD

The UK is reinforcing its leadership in European defense through comprehensive modernization, increased funding, and closer NATO integration.

· Strategic Defense Review – The most transformative UK defense review (SDR) in decades commits to an £87B multi-year plan focused on readiness, advanced technology, and global presence. The 62 recommendations include boosting munitions production, expanding ISR and C2 networks, prioritizing AI, cyber, drones, and long-range precision fires.

· NATO Alignment – The UK has pledged to reach 2.5% of GDP by 2030, backed by a £75B increase over six years. It continues to lead eFP forces in Estonia, drives Joint Expeditionary Force (JEF), and remains Europe’s largest donor to Ukraine with £18B committed. Its investments reinforce ISR, cyber and industrial capacities critical to NATO’s evolving mission set.

· Strategic Procurement – The UK agreed to purchase 12 nuclear-capable F-35A fighters.

NATO / NSPA

NATO and its acquisition arm, NSPA, are rapidly scaling to match Europe’s defense acceleration. In addition to the historic adoption of a 5% GDP defense threshold, allies agreed to quintuple ground-based air defense, expand cybersecurity and border security within defense spending metrics, and address critical supply chain vulnerabilities. Estonia announced the construction of a NATO base in Narva to reinforce the eastern flank, and the alliance launched its largest-ever weapons production surge to support Ukraine. Gen. Alex Grynkewich was appointed Supreme Allied Commander Europe. Meanwhile, NATO unveiled a modernized command structure to strengthen responsiveness across cyber, space, and multi-domain operations. However, a corruption probe involving NATO’s procurement agency adds new compliance scrutiny for contractors.

Since January 2025, NSPA has expanded its operational, logistics, and procurement support across multiple mission areas:

· OLSP – Denmark joined the Operational Logistics Support Partnership (OLSP)’s Host Nation Augmentation Services, enhancing multinational surge for NATO operations.

· Medical Support Partnership (MSP) – Sweden and Finland joined MSP to centralize medical procurement and planning for alliance missions.

· Multinational Missions – NSPA continues to support Finnish deployments to NATO Air Policing and Shielding Missions, KFOR (Kosovo), and Operation Inherent Resolve (Iraq).

· New Acquisition Directorate – Formed in 2025, it now manages procurement for major efforts, including NGRC and AFSC programs.

· Support Partnerships – 41 active multinational partnerships are managed by NSPA to consolidate procurement and logistics.

· Industry Collaboration – A new framework with the NATO Industrial Advisory Group (NIAG) streamlines partnership and strategic dialogue.

· Ammunition Supply Chain – The Ammunition conference brought together stakeholders to address 155mm production and material access bottlenecks.

· Ukraine CAP – The €955M Comprehensive Assistance Package (CAP) supports ISR, medical, and force protection contracting pathways.

· NCIA Battlefield Digitization – NATO’s NCIA hosted vendor accelerators focused on software-defined C2 and network resilience.

Major NSPA Awards

· Saab secured a multinational contract to deliver Carl-Gustaf M4 systems and munitions to France and the Netherlands.

· Planet Lab was awarded a seven-figure contract to deploy AI-enhanced surveillance and ML analytics across NATO regions.

· NHIndustries signed a 5-year support contract with NAHEMA for NH90 fleet readiness, covering 28,000 spare parts.

Upcoming NATO/NSPA Industry Events:

· NSPA Clean Energy Industry Event – July 2, Luxembourg

· NDTA & NSPA Transportation Industry Events – Week of July 7, Luxembourg

· ISOA Europe & NATO Conference – September 16-18, Bucharest

NATO’s new capability goals, expanded forward presence, and increased industry engagement represent a significant shift in European defense. For government contractors, aligning with NSPA, PESCO, and NCIA efforts is now essential. To learn more or position your firm for success in the NATO ecosystem, contact PTS NATO Lead Jim Shields.

PTS UPDATE

Q2 was a high-impact quarter for PTS, marked by industry engagements, strategic thought leadership, and the official launch of our newest offering: Precision Experts!

We kicked off the quarter with our inaugural PTS SES Career Seminar, held in partnership with the Senior Executives Association (SEA). The event brought together 53 SES leaders from 27 agencies for a candid evening of insight, transition strategy, and community building. LTG (Ret.) Scott Spellmon joined us as guest speaker, sparking conversations around life after federal service and the path to advisory, consulting, and executive opportunities.

Momentum continued at our PTS Executive Happy Hour on April 30, where over 50 senior executives gathered for an evening of connection and leadership reflections with LTG (Ret.) John B. Morrison, Jr.

In June, we hosted a first-of-its-kind PTS Executive Matchmaking Event, bringing together 50+ SESs (from 23 agencies), 15 Flag Officers (up to 4 stars), and 60 GovCon industry C-Suite executives. PTS designed the evening around one goal: intentional, impactful connection. And that’s exactly what happened. Unlike traditional networking events, this wasn’t about chance encounters or surface-level introductions. The Executive Matchmaking Event was built on data, intention, and alignment.

Following the success of the PTS Executive Matchmaking Event – and the insights it revealed – we are excited to officially launch Precision Experts: a flexible consulting and advisory model that connects GovCon organizations with senior-level experts for high-impact, fractional, and project-based engagements. This new practice will be led by Jason Hutchison, who will also help elevate our existing service lines and strengthen our industry voice.

As the workforce evolves, so must the way we engage talent. Traditional employment models don’t always align with the needs of government leaders transitioning out of service – or with agile GovCon firms seeking rapid insight without long-term commitments.

Precision Experts fills that gap. For companies, it offers on-demand access to trusted, strategic talent – whether you need pre-RFP guidance, insight into agency priorities, or mission-specific advisory. For experts, it means contributing on your terms. This is more than access. It’s alignment. And that’s what makes it work.

Beyond our efforts to support senior USG officials in transition, the PTS team was active across the U.S. and Europe. At ISOA Europe Industry Days in Wiesbaden in April, Aurore Jusufi, Julie Kmet, Jeton Musliu, Jake Frazer, Biz Zelalem, and Andy MacWilliams explored forward-deployed contracting and EU readiness. Then, at AFCEA Europe’s TechNet International in Brussels, Jake FrazerJake Frazer, Julie Kmet, and Besart Sadiku joined NATO and EU customers and partners in discussing transatlantic partnerships, strategic positioning, and opportunities for expanding footprint in Europe. PTS’s international reach and experience supporting missions-driven organizations across both U.S. and European markets make us uniquely positioned to assist partners on both sides of the Atlantic.

Stateside, Candice Smith and Isaac Khaneles hit the ground running at AFCEA TechNet Cyber and AWS Summit in Washington, DC, and joined the larger team to attend AFCEA NOVA’s Space IT Day, a gathering focused on the critical role of innovation and IT in supporting defense and intelligence missions in space.

Andrew MacWilliams and Jake Frazer attended the PSC Annual Conference at The Greenbrier, where Jake Frazer was featured in the Service Contractor Magazine, addressing executive talent trends in the new era of federal contracting.

PTS joined industry leaders at the Digital Transformation Summit, hosted by the Potomac Officers Club, to discuss how emerging technologies are reshaping federal missions and the workforce strategies required to keep pace. From AI adoption to cybersecurity talent pipelines, the focus was clear: transformation requires the right people. PTS is ready to provide the right talent to support the transformation!

Across every initiative this past quarter, one theme emerged: real connection leads to real impact. Whether you’re growing your team, launching a new bid, or seeking leadership aligned with mission and values, PTS is your partner for what’s next.

Coming Soon: Future of GovCon! Launching in Q3, Future of GovCon is a new podcast hosted by Jake Frazer that puts a spotlight on the bold voices and breakthrough ideas reshaping government contracting landscape. From mission-driven tech to leadership transformation, each episode goes deep with the leaders, innovators, and decision-makers building what’s next in the federal space. If you’re driving change in government contracting – or ready to start – this is the conversation you’ve been waiting for. Stay tuned for launch details, guest reveal, and the first round of episode drops. The future is coming fast. Be ready.

Upcoming Events (Q3)

POC Air and Space Summit | DC | July 31

DSEI 2025 | London | September 9 – 12

ISOA Europe & NATO Conference | Bucharest | September 16 - 18